AUTOMATE UNDERWRITING AND OPTIMIZE PORTFOLIO MANAGEMENT

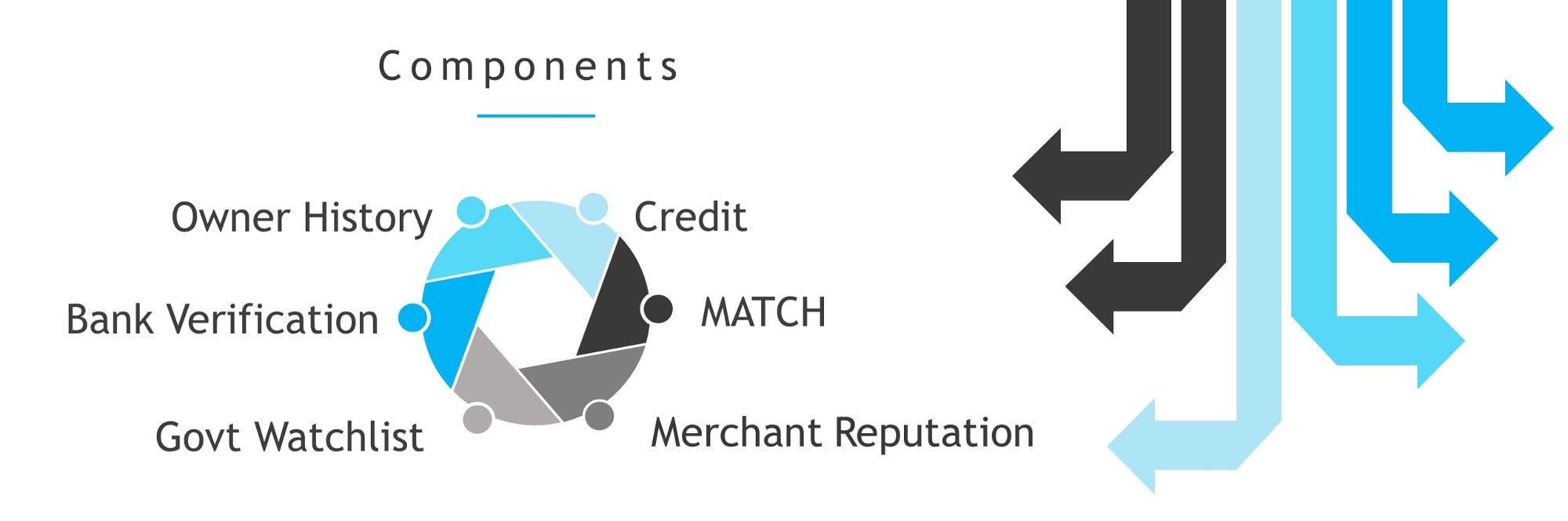

Our cloud-based platform delivers automated underwriting and risk management by utilizing your existing data provider accounts and multi-factor preferences. The result connects client registration to your underwriting, solutions boarding and ongoing portfolio management, while improving the enforcement of best practices at a lower cost.

"This technology platform provides us with a highly efficient framework to help our clients (banks and TPPPs) move forward with automation while further enhancing their pillars commitment to AML/BSA compliance by enabling best practices.”

- Jay Postma, CAMS, CFCS - BSA/AML Expert